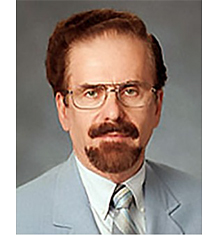

William Arnold Barnett is the Oswald Distinguished Professor of Macroeconomics at the University of Kansas, Director of Advances in Monetary and Financial Measurement at the Center for Financial Stability (CFS) in New York City, and Director of the Institute for Nonlinear Dynamical Inference in Moscow. His current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modelling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics, especially in financial and monetary economics. His MIT Press book, Getting It Wrong, won the American Publisher’s Award for Professional and Scholarly Excellence, and his book with Nobel Laureate, Paul Samuelson, Inside the Economist’s Mind, has been translated into six languages. He is Founder and was First President of the Society for Economic Measurement, Founding Editor of the Cambridge University Press journal, Macroeconomic Dynamics, and of the Emerald Group Publishing monograph series, International Symposia in Economic Theory and Econometrics, and originator of the Divisia monetary aggregates and the "Barnett critique." He is a Fellow of the American Statistical Association, Charter Fellow of the Journal of Econometrics, Charter Fellow of the Society for Economic Measurement, Fellow of the World Innovation Foundation, Fellow of the TANDO international policy institute, Fellow of the Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise, and Honorary Professor at Henan University in Kaifeng, China. Special issues of the Journal of Econometrics, Econometric Reviews, and the Journal of Financial Stability have been published in his honor. He is ranked among the top 2% of the world's economists in RePEc.